Children are always asked what they want to be when they grow up. As a parent, you want to make sure nothing stands in their way, especially something like the ability to finance their education.

Securing Your Child'S Future

Providing for child's future is a goal that is dear to our heart. We like to do nothing but the best we can. We like them to have a future that is brighter, bigger and better than our present.

Making an Estimate

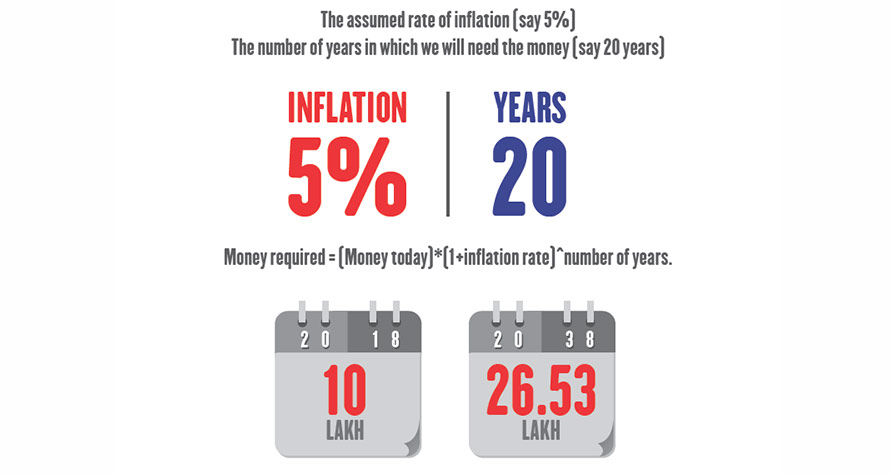

If it costs Rs.10 lakh to provide good quality education to your child today, to make an estimate of what it might cost in the future, we have to do the math using two more numbers:

Value of Rs. 10 lakh today will become 10 *(1.05)^20= Rs.26.53 lakhs.

Working for It

We do what it takes to get there. Most of the time, we assume that we should save a lot.

Are you Doing enough?

If our investment earns a steady

interest income, this means it earns

a simple rent from the entity using

our money. That rent, actually, will

just about match inflation.

If you invested Rs.5000 every

month (Rs.60,000 every year)

for 20 years @5% rate of

interest per year, you would

have accumulated only

Rs.20.55 Lakh. That would be a

shortfall of ~6 lakhs !

So when you fund your child's education with simple interest-bearing products,

you may just match inflation, and not do enough.

Your Alternative Choice

If your goal is far away, the money you save should grow bigger and beat inflation. That is why you need equity investments. Equity investing is a choice that enables growth and capital appreciation. The user of your funds won't simply pay you a fixed interest. The growth in their business, is reflected in your return, through the appreciation in the value of the equity share. That can make all the difference.

Isn't it Risky?

Equity investing is ideal

for long term goals,

since it is capable of

beating inflation

But not all businesses do well. Some succeed spectacularly. Some fail miserably.

That is why trading in shares, or buying this and that can be very risky.

You cannot bet on equity shares on your own and hope to make money from that.

Diversification Is the answer

Your savings are likely to appreciate in value over time, if you instead invested preferably through Mutual Funds.

A diversified portfolio holds shares of big and small, old and new, Indian and foreign i.e. diverse companies. This means you are likely to see ups and downs in the economic cycles, but as long as there are successful businesses out there, equity investing will remain worthwhile.

Choose Equity-Oriented Funds

To beat inflation and meet your cherished long-term goals, choose equity-oriented mutual funds.

They are professionally managed for a fee

They are reviewed and monitored by fund managers

They are well regulated by the regulator

They publish their performance and are widely analysed

Why children's funds From mutual funds

1. Children's Funds from Mutual Funds are products specifically designed for your dreams for your child. It adds the benefit of equity to an interest-earning portfolio of debt products, to help you fight inflation.

2. Children's Funds have a lock-in of at least 5 years or till the child attains age of majority whichever is earlier.

How to use it?

Begin a systematic investment plan at an early date when your child is young.

Increase the SIP amount every year by at least 10%.

Top it up whenever you can. Invest the gifts and prize money into the fund.

Once your child is 18, draw from the fund to meet educational expenses.