Even if it seems a long way off, it pays to plan for your retirement as early as possible. Most people end up relying on their children and their own savings for income in retirement. How much you'll need to save will depend on your own circumstances, but the sooner you start, the more you will have.

Golden Years of Retirement

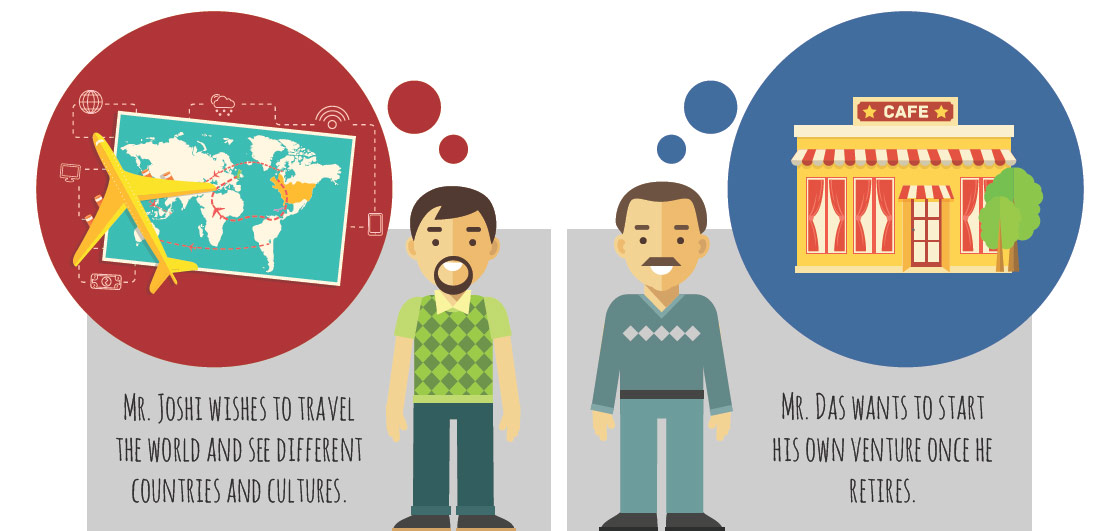

Mr. Joshi and Mr. Das have retired from their service of almost 30 years. Both friends have been looking forward to these golden years and wish to be able to pursue their dreams on retirement.

Each person has his own idea of spending his retirement years. Retirement Planning is all about being able to realize these dreams while leading a comfortable retired life.

Reality Check

Mr. Joshi has been able to amass a large retirement corpus in addition to retirement benefits from his employer. He is comfortably able to withdraw from his corpus for meeting his routine expenses and also fund his travels.

Mr. Das has invested his retirement corpus into his business. His investments earn him interest but that does not match his household and new business expenses. He is finding it very difficult to meet ends.

Retirement - A Key Financial Goal

- ▣ Always had retirement as a key goal.

- ▣ Believed in planning ahead for future needs and contingencies.

- ▣ Started saving for retirement as soon as he began his career at 25 years.

- ▣ Believed in living in the present.

- ▣ Thought that there's enough time to plan for retirement.

- ▣ Prioritised other goals to retirement.

- ▣ Started retirement planning in the mid of his career.

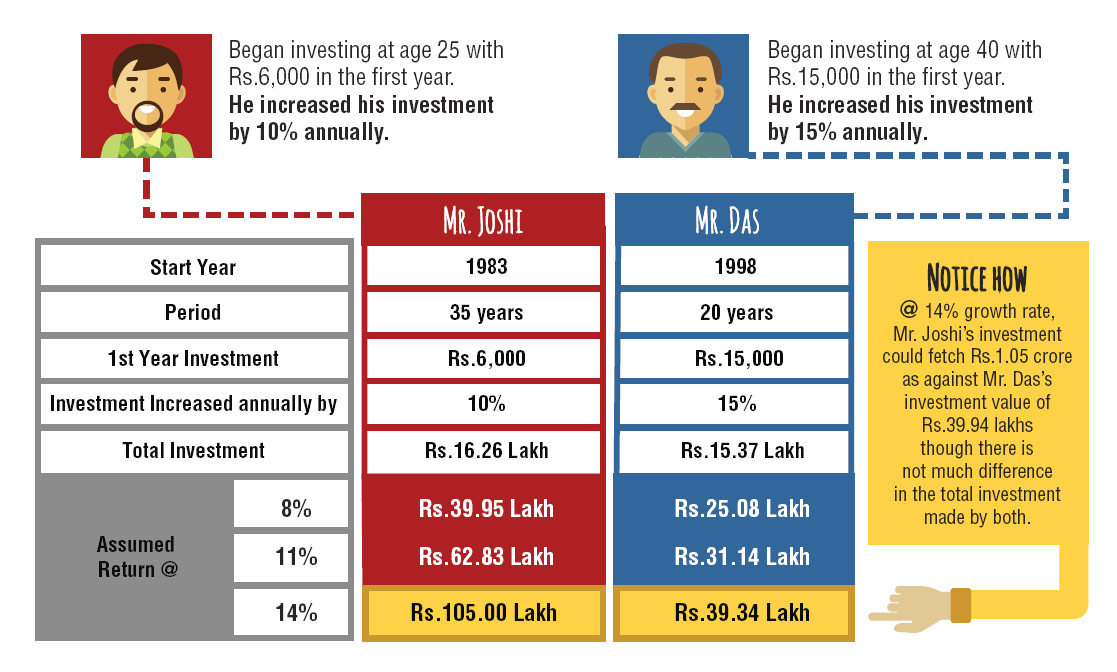

Compounding works wonders when you start early

The above table is for illustration purpose only to explain the concept of starting investments early & shall not be construed as indicative yields/returns of any asset classes.

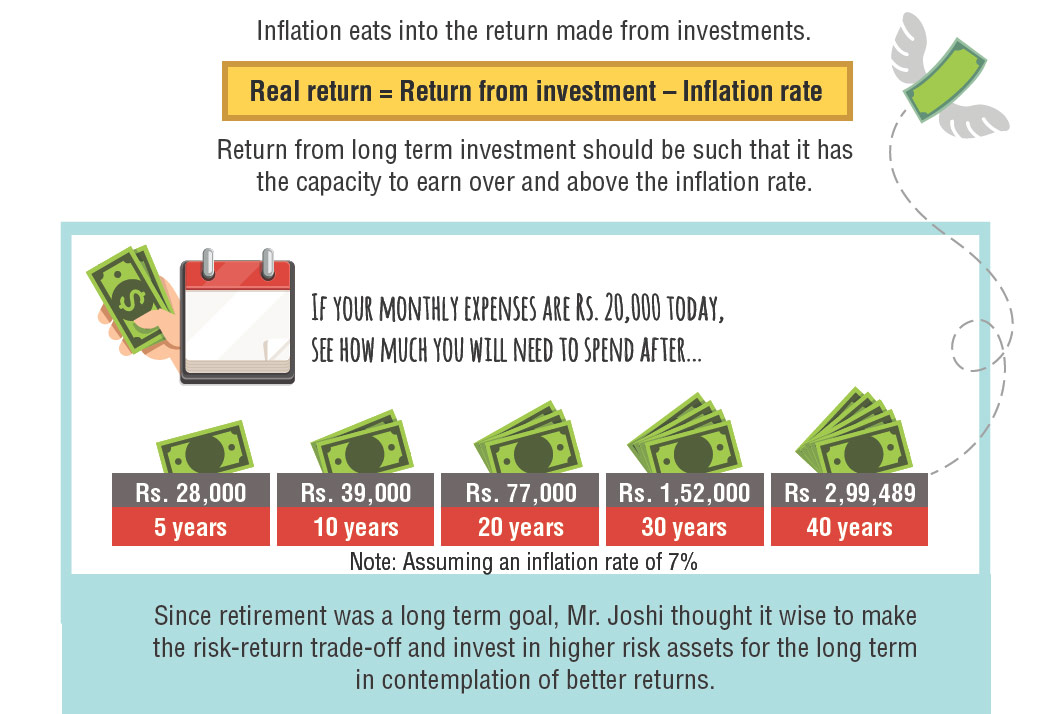

Cover for inflation

Underestimating Inflation

Estimating Inflation does not only involve estimating increasing prices, but also the changing life style and price to be paid for the changed lifestyle.

Mr. Joshi understood that to keep up with changing times, he would have to incur these expenses and needed to make provision for the same.

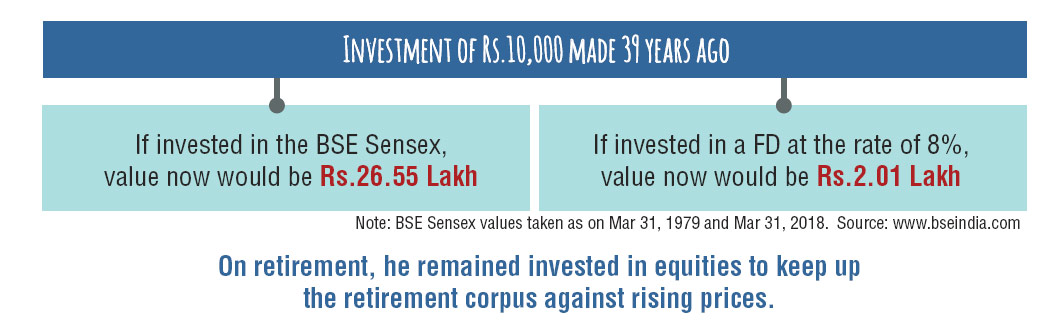

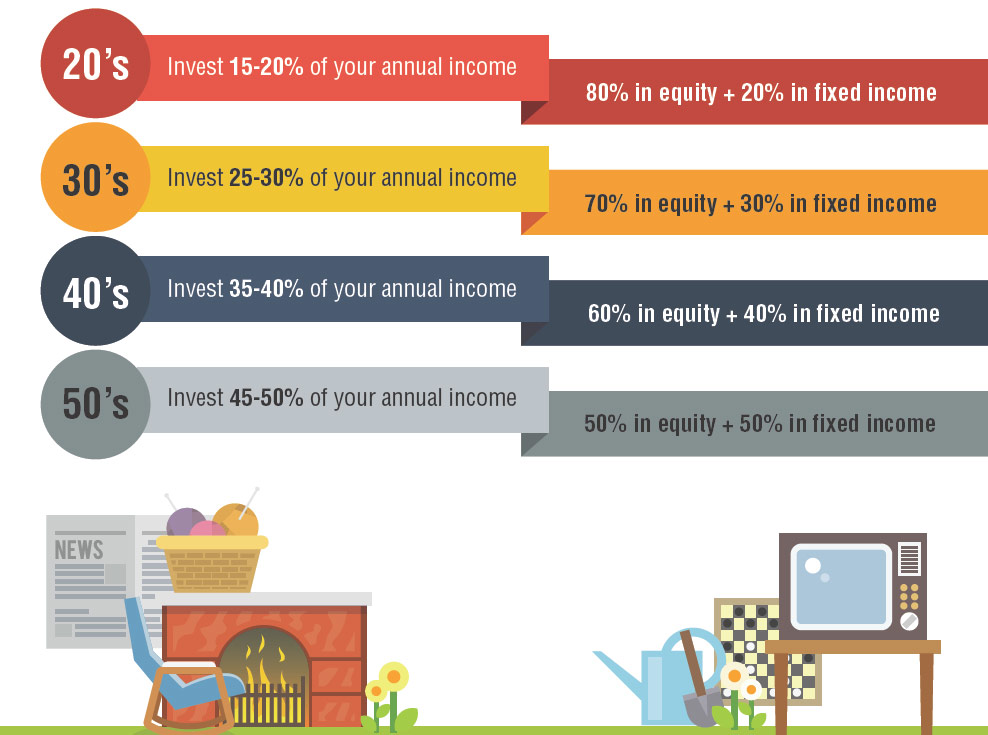

Strategic allocation to Equities

During the Accumulation (Earning) phase Mr. Joshi

made a strategic allocation to equities with a small

allocation to fixed income.

He gradually shifted allocation to low risk fixed income

investments with lower allocation to equities towards

retirement age.

Equities tend to be volatile in the short term but have given superior inflation adjusted returns over the long term.

Historical performance indications and financial market scenarios are not the reliable indicator for current or future performance.

Past performance may or may not be sustained in future. Investors are requested to consult their financial advisor before making any investment decisions

Evaluate investment choices

During the Accumulation (Earning) phase Mr. Das limited his investment choices to traditional investments such as gold and fixed deposits.

Mr. Joshi chose equity. To minimize risks in equities, he chose a diversified equity mutual fund and signed up for a systematic investment plan.

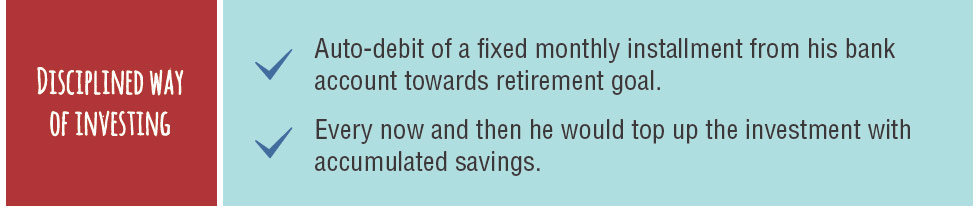

Save Big if not early

Mr. Das was laid back and lost valuable time. Mr. Das could have done well had he invested larger amounts when he began investing late in his 40's.

If he would have set aside 30% to 40% of his

annual earnings for retirement, he would have been

in a much more comfortable zone at retirement.

It helps to make additional lump sum top ups to

retirement funds during the peak income phase.

Incomes usually peak out during the middle of one's career

Social security

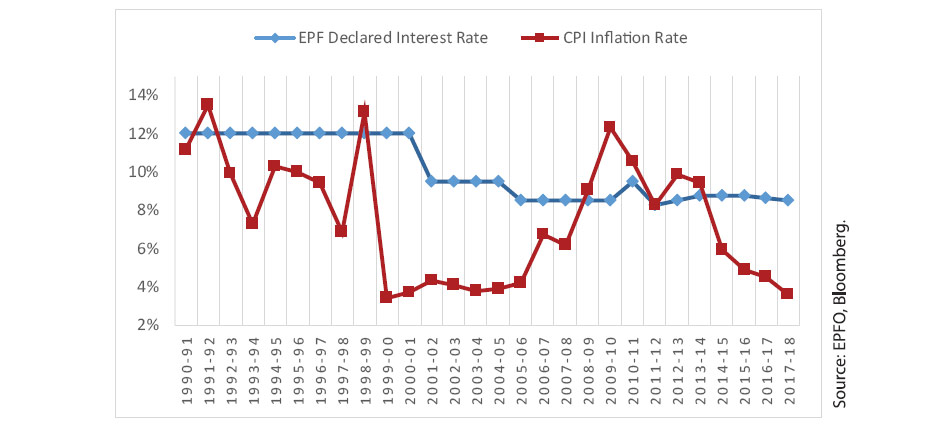

EPFO declared interest rate vs CPI inflation rate

Mr. Joshi realized that he was not eligible for pension or any other social security benefit of the government. Mandatory retirement benefit schemes such as the Employees Provident Fund has not been able to provide significantly higher returns over inflation. Apart from the monthly PF contributions, he saved additionally in growth oriented assets to create a large retirement corpus.

Saving for 30 years

Increased Life Expectancy.

The retirement kitty needs to work to provide

regular income for the next 25 to 30 years.

Income stops at retirement, but inflation

continues to erode real income from the

retirement corpus.

After retirement, Mr. Joshi remained partly invested in equities and

partly in fixed income mutual funds that enabled regular payouts.

Mr. Das, however, continued his FDs. Soon, the interest payouts

seemed too little to suffice the rising expenses.

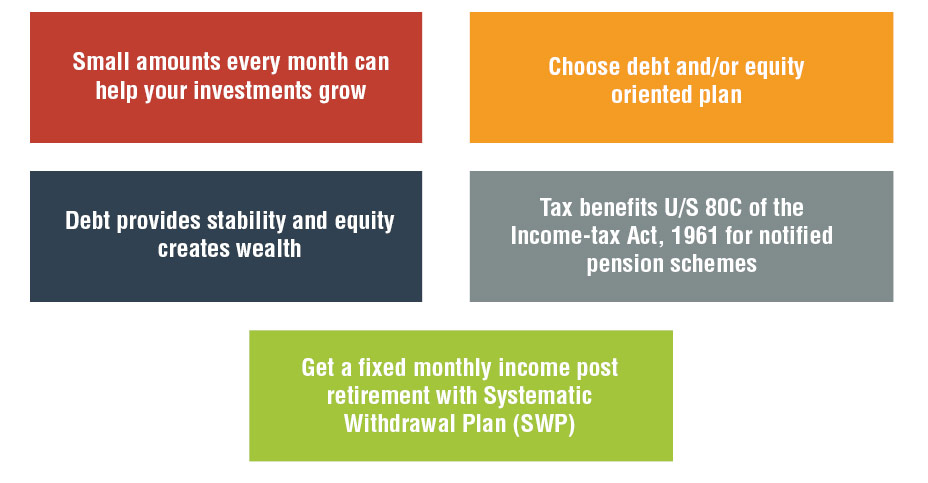

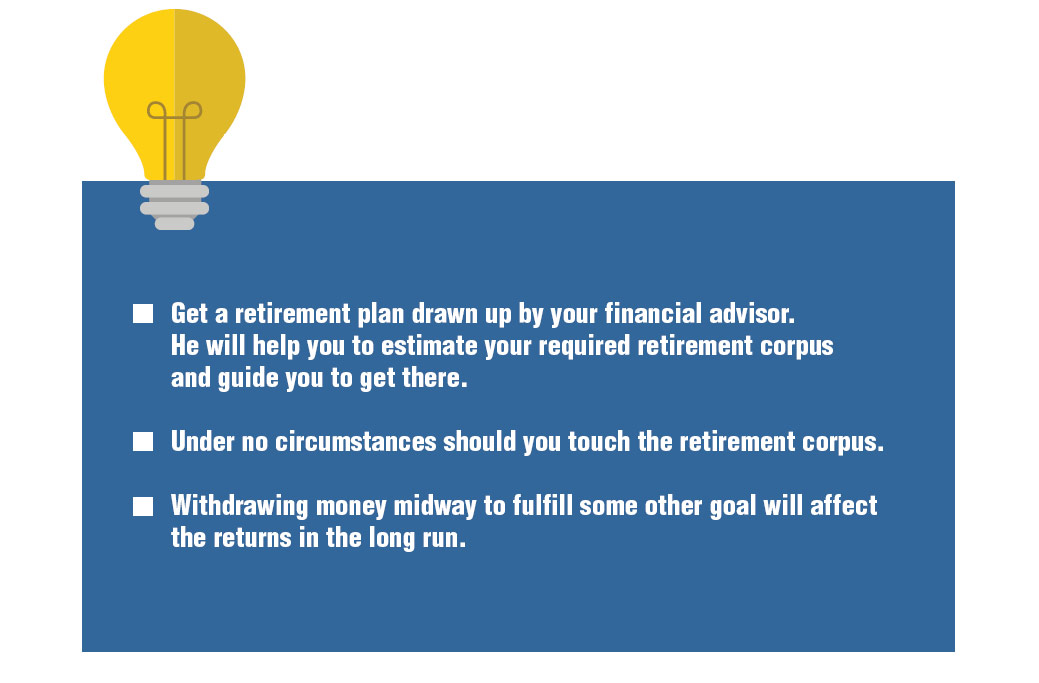

Smart things to know about retirement planning

To be able to Comfortably Retire at 60

Plan Your Retirement Today With Retirement-Oriented Mutual Funds

We often leave retirement planning for another day. But the fact is, expenses will only rise due to inflation as you get older. Retirement oriented Mutual Funds are a great vehicle for building retirement corpus and by investing in these funds, you benefit in more ways than one: